Arbitrum Multi-sig Support Service (MSS)

Abstract

We propose creating a structured multi-sig framework to facilitate funded programs within Arbitrum DAO to reduce operational spend and increase proposal efficiency.

As of April 2024, the DAO administers six programs with a designated budget for multi-sig signing. The aggregate budgeted cost across these programs for signers stands at 158,000 ARB, with an annualized total expenditure, based on estimations, of 470,000 ARB or $627,840 at an ARB price of $1.34. This is a high cost for the DAO to pay on a purely operational function, especially considering that these operational costs will likely rise as more programs are funded.

We propose creating a “Multi-sig Support Service” (MSS) to unlock significant cost-saving opportunities, lessen committee fragmentation, ensure signers are competent with multi-sigs, and reduce friction for contributors creating proposals. The MSS will comprise 12 elected individuals to all DAO-funded multi-sigs. They will be compensated a base USD amount, paid in ARB, for performing these services across the DAO.

This proposal also funds the implementation of r3gen monthly Token Flow reporting on inflows (revenue) and outflows (spend) across the DAO as well as providing detailed information and analysis on spending from MSS multisigs. Together, this proposal will help create a “backroom finance” function within the DAO that can be used across different initiatives.

The proposed changes offer the potential to generate substantial cost savings, estimated to be ~$315,000 per annum, while increasing efficiency, transparency, and security of DAO spending.

Motivation

The Arbitrum DAO oversees six programs which pay multi-sig signers. Each multi-sig typically has five signers, except for the STIP and STIP backfund programs, which share the same multi-sig and have nine signers budgeted for. The table below outlines these programs, including the amount funded, duration (in months), and annualized figures to project a forecasted amount if future programs were to continue in the same manner.

Here’s a breakdown of the programs:

The analysis underscores the operational unsustainability of the current expenditure level, with an annualised cost totalling $627,840 USD based on the average ARB price of $1.34 between August 7, 2023 and April 30, 2024, the period starting when Arbitrum DAO’s first multisig was funded.

The cost per transaction appears excessive when comparing these figures against the volume of unique transactions sent from each multi-sig. While analysis for all multi-sig wallets is included for completeness, the STIP/Backfund multi-sig provides the clearest picture of the “cost per transaction” due to its proximity to completion.

This analysis highlights the urgent need for restructuring and cost optimization within the Arbitrum DAO to ensure financial sustainability and operational efficiency in the long term.

It is also worth highlighting that the current structure has individuals appearing across multiple different multi-sigs, drawing income from each.

Currently, the DAO experiences a significant dispersion in its structure, where each funded program operates its own multi-sig. This fragmentation not only leads to redundancy but also elevates the overall cost of operations. Through the “Multi-sig Support Service” (MSS), we can eliminate these inefficiencies and significantly reduce unnecessary expenditure.

Additionally, individuals on multi-sigs are generally not elected, posing a challenge in consistently ensuring that only the most trusted and competent members manage these critical roles. By shifting to an elected model within the MSS, we can enhance transparency, accountability, and professionalism, ensuring that every signer meets a high standard of trust and competency.

Finally, contributors currently face friction in advancing proposals due to the need to wrangle signers, which can delay or deter the proposal process. The MSS aims to streamline this process by providing a reliable and consistent team of signers to be included in proposals, thereby reducing the time and effort of contributors, and accelerating the pace at which the DAO can execute its initiatives.

By creating a structured multisig committee, process, and reporting cadence around spending, the DAO will be better equipped to service its plethora of proposals that require payments and maintain transparency around the programs.

Proposed solution

The proposed framework for the Arbitrum DAO aims to address these issues by:

- Arbitrum DAO elects 12 signers via Snapshot weighted voting, shielded with Shutter

- Signers, when submitting their application to join the MSS, may opt in to be an MSS Chair, who will be responsible for communicating to the DAO on the MSS’s behalf. The three opted-in signers with the highest weight according to Snapshot will be allocated MSS Chairs.

- For each new DAO initiative requiring a multisig, a new 12 signer multisig is set up.

- The signing threshold will be dependent on the total dollar denominated value of the wallet i. 6/12: <$1M ii. 7/12: $1M-$5M iii. 8/12: $5M-$10m iiii. 9/12 $10M-$50M

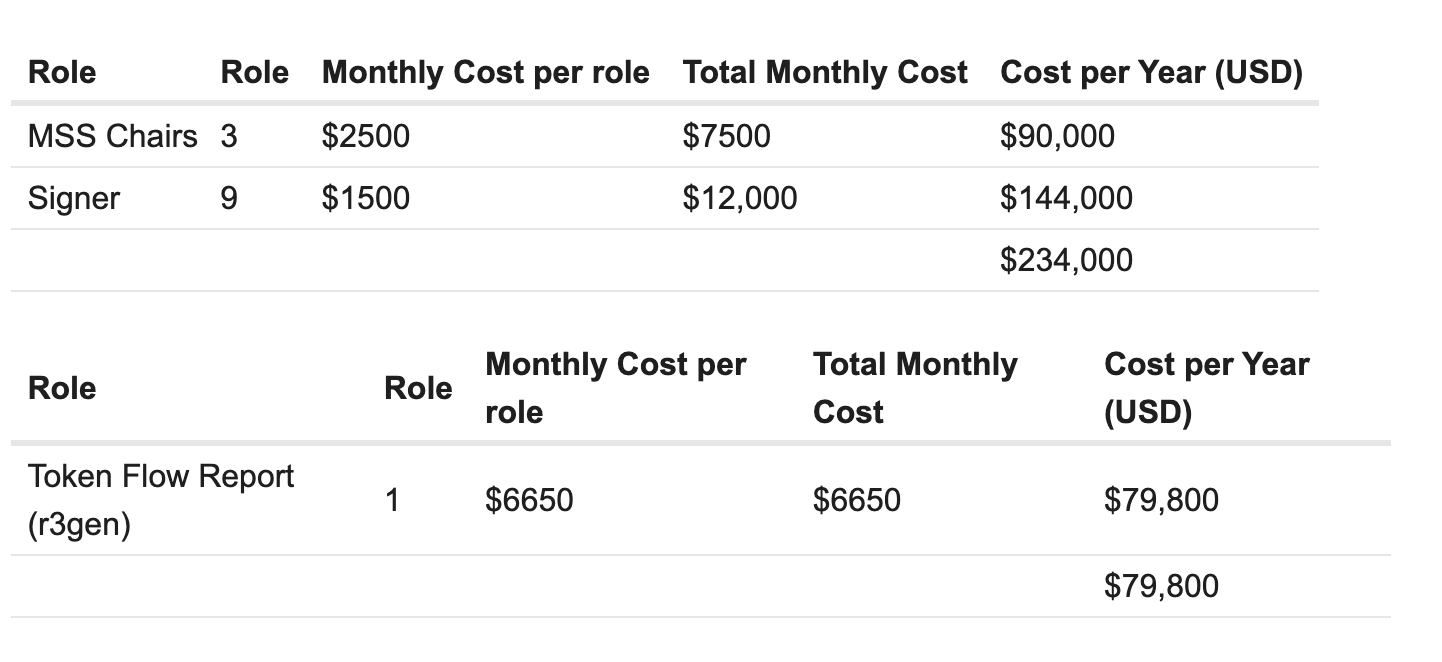

- Signers are paid a fixed monthly fee of $1500 in ARB using spot price at the time of payment. The MSS Chairs will be paid $2500 per month in ARB using the spot price.

- We feel denominating the payment in a $ value is important to ensure the DAO pays a fair price for service rendered without the risk of ARB price movement leading to a series of overpayment or underpayment to signers for their duty.

- This will be paid out monthly from the MSS multi-sig, which will be a 6/12 including the entirety of the MSS.

- Payment for multisig signers will only start once the first new multisig is onboarded under the Multisig Support Service MSS structure.

- Existing multi-sigs have the option to “opt in” to the MSS structure. If they do so any existing ring-fenced budget for multisig signing should be sent directly to a new MSS multisig. An MSS Chair will coordinate with the Program to manage the transition process. We expect a gradual turnover given the incentives at play and that most multi-sigs will not opt into the transition process.

- The same process is repeated to onboard new MSS members 12 months after the first is complete (starting the process 4 months before the term is up to allow for ample time)

The funds in the multisigs belong to the DAO and the signers act as grant managers on behalf of the DAO in coordination with the Arbitrum Foundation.

We suggest the program is capped at initiatives seeking funding of $50M or less. This will help ensure that the program is not bottlenecked by one single initiative. For programs seeking more than $50M in funding, we suggest inspiration in design be taken from this model while creating a dedicated multisig committee and process.

MSS Mechanics

Who would be a suitable multi-sig signer?

- Actively involved in the Arbitrum ecosystem

- Prior experience being on multi-sigs. Understanding of batched transactions and transaction builder.

- All multi-sig signers will also undergo training on security best practices and multisig efficacy at the commencement of their role. This training will be completed by Entropy Advisors.

- Able to complete KYC

- The Arbitrum Foundation will conduct KYC on all multisig signers to ensure they are compliant and can serve this role for the DAO.

- Organisation or professional signers can submit a nomination to be a multi-sig signer. Only one member per organisation.

- If nominating an organisation, one member of the company should be listed as the primary point of contact.

Creating new MSS multisigs

The process flow for creating new multisigs is as follows

- Snapshot vote passes

- Multisig is created by MSS Chair and signers onboard. The 3 chairs will rotate multisig creation responsibility

- Proposal passes Tally

- Vaults must be named well to help with organisation

Processing payments through MSS multisigs

To improve security and clarity of payments running through MSS multi-sigs, the following financial controls processes will be maintained:

Payment request: approval flow

At the outset programs using the MSS will define their payment approval flow, including

- Which individuals can request a payment be made “payment requestor”

- Which channel do they need to request it on “payment request channel”

- Who else is required to approve it, triggering the payment to be queued via the multisig “payment approver”

- A list of approved wallet addresses (maintained in On-chain Den)

This is an important security step to mitigate the risk that a Program member’s personal accounts will be compromised and used to trigger a payment by the multisig to an unintended party. (i.e. hack someone’s Telegram and tell the grants program to queue a payment up to the hacker’s wallet).

An example of this structure

- Disruption Joe, Shawn and Ben can request a msig payment.

- Request made in “PL Payment” Telegram group”

- Supporting evidence of the payment will need to be produced to be reviewed by the signers (a forum post, an invoice, a milestone sign off etc)

- One written approval as indicated by “

” on the payment message required from Joe, Shawn or Ben. “payment approver” cannot also be by “payment requestor”

” on the payment message required from Joe, Shawn or Ben. “payment approver” cannot also be by “payment requestor”

Given the abstraction of responsibility from multisig signers and program operators, this step is important to ensure the security and integrity of fund transfers.

Payment request: format

Payment requests should be structured as follows by the “payment requestor”

Name of supplier | Category | nature of the payment | supporting evidence

This will allow for multisig approvers to better understand the details of the payment they are being asked to process. Moreover, by ensuring clear supplier name and categorization a more efficient reporting flow can be maintained. The category of payment is to be defined by the program itself (i.e. “Tooling”, “Contributor payment”, “legal fees”). If the DAO wishes to move ahead with Token Flow reporting, r3gen finance will also conduct discovery with each program team to help them define and confirm program reporting categorization at the outset of their program.

Payment signing: Den implementation

- To aid in the efficiency and security of multisig programs at Arbitrum, we propose the implementation of Den across all MSS multisigs.

- Efficiency: Den will automatically notify Arbitrum multisig signers when there is a transaction to sign. It will allow them to see exactly what you’re signing at a glance and cut through the noise by auto-tagging and DMing signers

- Security: Den helps you know what you’re executing and identify malicious transactions. It allows Arbitrum multisig signers to: Simulate and decode transactions before they execute them and see the outcomes of transactions before they are signed. It also helps signers easily understand complex transaction inputs and automatically see what’s behind any address.

Conflict of Interest Policy

In order to maintain the integrity and impartiality of the MSS, signers must adhere to a strict Conflict of Interest Policy. This policy ensures that all decisions made by MSS signers are in the best interest of the DAO and free from personal gain or undue influence.

A conflict of interest occurs when an individual’s personal interests interfere, or appear to interfere, with their responsibilities to the DAO. Conflicts of interest include, but are not limited to:

- Being directly compensated by the Multi-sig: Receiving payments, reimbursements, or any form of financial benefit directly from the multi-sig for which the signer is responsible (Exclusion for the MSS multisig itself which will be paying it’s signers directly for their services)

- Authoring a Proposal that Funded the Multi-sig: Proposals a signer has authored or co-authored, which directly results in funding or operational changes to the multi-sig.

- Personal or Financial Relationships: Having financial relationships with any parties that stand to benefit directly from the signer’s decisions in relation to the multi-sig operations.

- Other Conflicts: Any other circumstances where the signer’s ability to act in the best interest of the DAO may be compromised.

Procedure in the Event of a Conflict: If a conflict of interest arises, or if a situation arises that could be perceived as a conflict, the signer must:

- Provide Disclosure: Promptly disclose the conflict to the other members of the multi-sig committee.

- Recusal: Abstain from participating in discussions and decision-making processes related to the conflict.

- Reduced Signer Multisig: In the scenario that there is a situation deemed a COI, a multisig should be created without this signer(s) included. A new threshold >50% of the total remaining signers should be included. For example, if there are 3 signers with a COI for an initiative, the new multisig for this initiative would maintain 5/9 threshold and total signers.

All COI executions must be documented by an MSS Chair and communicated to the DAO in a forum thread dedicated to MSS operations.

Removal of MSS members

There are 2 paths to the removal of an MSS member:

- DAO Snapshot: Any DAO member can propose a Snapshot vote to remove an MSS signer. The proposal should clearly state the reasons for removal and provide evidence supporting the claims. A simple majority of votes cast by the DAO members is required for the removal to be approved with an 80M ARB Quorum (defined as total ARB votes).

- MSS Member Agreement: If at least 8 MSS members (8 out of 12 members) agree that a signer should be removed due to breach of duties or conflict of interest, they can initiate the removal process internally. The agreement must be documented and publicly disclosed to maintain transparency. Analytics on signer activity from Den may be used as supporting evidence.

If a member is removed via the DAO Snapshot or MSS Member Agreement the member will immediately lose further compensation. Once a member is removed, the following steps will be taken to ensure continuity and maintain the governance structure:

- Interim Measures: The MSS may appoint an interim member to serve temporarily until a new member is officially elected. The 3 chairs will collaborate and decide how to select the new member.

- Subsequent Snapshot: A subsequent Snapshot vote will be held to elect a new MSS member. This ensures that the DAO participates in selecting a new signer, maintaining democratic and transparent governance.

All removal proceedings, details around the new signer, and the reasons for the removal must be documented by an MSS Chair and communicated to the DAO in a forum thread dedicated to MSS operations.

Expectations of MSS members

Transactions are expected to be promptly (within 24 hours) reviewed by all signers, and if approved through the process outlined above, signed. While we realise that there will be times when a signer may not have internet access or some other deterrent to signing, these are expected to be few and far between. If there are more than 3 lapses in expectations over the course of a 2 month period, chairs are expected to communicate that to the DAO and potentially remove the signer.

Clawback Capability

We are in the process of implementing Zodiac Governor Module in the first multisig to so that the DAO has the ability to clawback funds and replace multisig members. Please note that the Zodiac Governor Module is an imperfect mechanism because it requires a DAO proposal to execute changes, and multisig signers can move faster than the DAO.

For future multisigs, we believe each multisig should be set up with the DAO maintaining the ability to clawback funds. In order to execute this, multisigs should be set up using the same model as the security council, by making upgradeexecutor as a module so that DAO maintains full authoritative power. https://github.com/ArbitrumFoundation/governance/blob/06039ce92be07d448838e4ab1e2e29c3985356f0/src/security-council-mgmt/SecurityCouncilMemberSyncAction.sol#L76-L95

We believe this same mechanism can be used to transfer ownership of the multisigs to new members when new elections take place in 12 months. This might require a slight technical change, we are awaiting confirmation from the Foundation.

Token Flow Reporting

r3gen Reporting on Token Flow

Token Flow | Scope To aid in the transparency and clarity of reporting within the DAO, we are also proposing the publication of a monthly “Token Flow Report,” which will include illustrate expenditure amounts and breakdowns for all Arbitrum MSS-managed multisigs. In addition, r3gen finance will provide insights on inflows from Sequencer Flows and a high-level summary of other direct outflows from the Arbitrum Treasury to programs not coordinated under the MSS framework.

This approach will synergise with the operational execution created by the MSS to provide holistic insights into expenditures and the movement of Token in/out of the Treasury. Moreover, it will reduce the finance-admin burden on individual programs, relieving them of the need to track, draft, and publish exhaustive financial updates themselves whilst also providing the DAO with a clear mechanism to ensure spending within the organisation is consistent with the structure outlined within each proposal.

Within this role, r3gen finance will also lead the development of deeper financial insights and be open to requests by delegates and the community for further specific analysis. This can be requested either via a google form or by commenting directly on the report in the forum. Ultimately, this will enable the DAO to have, at it’s fingertips, the detailed financial insights it needs to support decision-making.

With the inclusion of Token Flow Reporting, the DAO can unlock the next layer of accounting and reporting on top of the MSS and together creates a holistic backroom finance function to provide the DAO with much-needed data around spending. This will enhance the DAO’s transparency, accountability, and impact.

We encourage you to review the first iteration of the Token Flow report to get a sense of its design.

Moving forward, financial items within the report will include, but are not limited to:

- Transaction fees, split between the various components of the fee

- L1 base, L1 surplus, L2 base, L2 surplus fees

- Fee inflows into DAO-controlled wallets

- Sequencer fees (L1 base fee)

- Fee outflows into the sequencer’s wallet

- Treasury holdings, including the breakdown of treasury allocation to various underlying tokens

- Forward-looking spending estimations based on active proposals

- Runway scenario forecasting based on historical/projected spend

- DAO expenditure by:

- Category (such as user incentives, direct grants, grant programs etc.)

- Program (such as STIP, LTIP etc.)

- Function (such as committee members, advisors etc.)

- Comparison of total proposed spend vs. actual spend to date for each major DAO-funded initiative, split between each function within the program where possible

- Contributor Spending Analysis

- Multisig Spend Analysis

- Detailed Statement of Token Flows in each of the major tokens the DAO operates in, highlighting

- The starting token balance

- Inflows of the token (“income”)

- Outflows of the token (“expenditure”)

- Closing token position

This report is just the starting point. With community feedback, we will continue to develop and iterate on the monthly token flow report to provide deeper insights and analysis of what the community wants to see. This team will host a monthly finance call on the public calendar to discuss the report’s outputs and collect community feedback to inform the next iteration.

If you have any specific feedback you would like to see reflected in the report we encourage you to reach out to Pepperoni_Jo3 or Jono_Gibbs on Telegram.

Token Flow | Team

Token Flow Reporting at Arbitrum DAO will be coordinated by a team of four (Elliott, Jono, Matthew and Pepperoni Joe) who bring professional “Big Four” expertise and extensive experience working across top web3 protocols, including Swell, Aave, Gitcoin, Index Coop, Inverse Finance, Squid, Vote Agora, Enzyme, Treasure.

Token Flow | Pricing for Token Flow Report:

$6650 USD per month paid upfront in ARB on the 1st of the month using USD/ARB spot price. This includes the web3 accounting sub-ledgers fee and other monthly tooling costs (approximately $750). Work has been ongoing since June to prepare the first Token Flow Reporting which will be published in August, covering the DAO’s finances from Genesis to July 2024. The full monthly payment for August will be paid on the 1st of August, OR when the Tally vote is successfully passed and multi-sig set up to receive funds, whichever is latest. Work done to prepare the report through June and July will not be billed; that will be free on us (r3gen) for the DAO.

Estimated Savings

Current Structure

Project forward estimated multisig cost for the DAO is a challenge, but assuming multisig costs project in line with historical, some future scenarios of yearly cost are displayed below:

*assuming ARB allocation cost per multi-sig breakdown as aligned with historic

Current spend on multisig with Arbitrum DAO is high, and spending could increase significantly if the number of new multisigs or ARB price increases significantly. This indicates that implementing this proposal would be of significant financial benefit to the Arbitrum DAO.

Proposed Structure For implementation of all aspects of this proposal, we estimate the structure will incur a cost of $313,800 per year.

We propose an allocation of 600,000 ARB to fund an approximately 1+ year multi-sig budget for the DAO. As compensation is denominated in $, but paid in ARB, the specific duration that this budget will fund signers cannot be accurately determined. Assuming the program succeeds, a renewal proposal will be drafted to top up this budget to fund continued signer payments. This will be done in parallel to a reelection process of signers performing this function.