[Non-Constitutional] - Subsidy Fund Proposal from the ADPC

Disclaimer: a small % buffer has been inserted so as to ensure that we are able to OTC $2.5m worth of ARB. Remaining ARB will be sent back to the ArbitrumDAO Treasury.

Executive Summary

As voted on in the ADPC proposal here, one of the key tasks of the ADPC was to conceptualize and structure a subsidy fund for the Arbitrum DAO. As per the proposal passed on 25-Apr-24, the Arbitrum DAO will fund 1 cohort of 8 weeks (2 months) for a total fund size of $2.5 million worth of ARB.

Following the rejection of this proposal which sought to set up a Sub-Committee for the Security Services Subsidy Fund based on community feedback received, the Arbitrum DAO Procurement Committee (hereinafter referred to as the ‘ADPC’) will be responsible for facilitating the selection of projects that will benefit from the whitelisted security audit service providers selected via the ADPC’s procurement framework, as originally proposed in the Subsidy Fund Proposal.

Proposal Request

We propose the creation of a procurement subsidy fund allocating up to $2.5 million worth of ARB to provide financial assistance to both new and existing projects within the Arbitrum ecosystem.

These subsidies will be exclusive to a pre-approved whitelisted set of security audit service providers, selected by the ADPC, who will publicly display their fees. This approach eliminates the need for the ADPC to assess the reasonableness of funds requests.

The aim of the subsidy fund is to incentivise participation and growth among smaller projects helping them to overcome barriers to entry, such as challenges to acquire funding to pay for the cost of robust security audits.

A benchmarking exercise was conducted with various security audit service providers, with this form being shared with 10 service providers (including the likes of Spearbit, Halborn, Nethermind, Three Sigma, Guardian, Zellic, etc.) on their scope of services and fees associated. Based on this, we have estimated that each project will require a 2-month security audit at an average cost of $200K. This will enable the ADPC to potentially fund up to 12 projects; however, it should be noted that the average of $200K is an estimate and fees are usually specific to each project, each project requires a scoping exercise, and audit costs will vary based on the size of the codebase, complexity, etc.

Subsidy Fund Design & Approach

Exec View

· Up to $2.5 million worth of ARB allocated to spend on whitelisted security audit service providers, with an average amount of $200K worth of ARB allocated per project and a max cap of $250K per project (10% of the subsidy fund available).

· ADPC will be responsible for selection and oversight.

· The Subsidy Fund will be distributed across 1 cohort of 8 weeks.

Key Pillars

(A) Subsidy Fund Principles and Criteria

Core Principles Underlying the ADPC Subsidy Fund

Before considering a subsidy application, applicants should carefully evaluate the need for support. The purpose of these guidelines is to clarify the subsidy program and make the process as straightforward as possible.

All applicants should keep in mind the following key principles:

1. Transparency & integrity - Applicants must disclose any potential conflicts of interest and receipt of any prior funding.

2. Encouragement of investment - Subsidies should incentivise investment that would not otherwise occur without the subsidy. They should not cover costs that the beneficiary would have funded independently in the absence of any subsidy.

3. Proportionate and necessary - Subsidies should be proportionate to their intended objective and limited to what is necessary to achieve it.

4. Economic neutrality - The requested subsidy amount should not confer an economic advantage. It should be provided on fair terms, comparable to what could reasonably be obtained on the market.

5. Consideration of funding options - Applicants are expected to explore all available funding options and responsibly choose the option that best suits their needs.

6. Enhancement of beneficiary security - Subsidies should bring about changes that enhance the security of the beneficiary’s protocol.

7. Positive impact on the Arbitrum ecosystem - Subsidies should have a beneficial effect on the Arbitrum ecosystem, contributing to its growth and sustainability.

8. Value for Money - The evaluation method should ensure decisions maximize both financial and non-financial value to Arbitrum.

9. Probity - Subsidies should be issued in an environment that ensures fairness, impartiality, and compliance with established guidelines and rules. There will be an emphasis on transparency, accountability, and integrity throughout the procurement process, evidenced by the development of this publicly documented Means Test methodology. This focus on Probity will mitigate procurement risks and safeguard the integrity of the procurement process.

10. Risk Management - Risk management policies will be implemented to identify and mitigate procurement risks.

11. Engagement with SMEs - We have invited a wide range of organisations to participate, all of whom will be subject to the eligibility criteria.

12. Cyclical Whitelist events - We will have clear rules for cyclical whitelist reviews to open a pathway for future applicants and new market entrants.

Means Test: Criteria for Evaluation

The reason for this approach over a purely quantitative approach is that most projects, especially the smaller ones being targeted within this subsidy program do not possess obvious immediately measurable metrics.

The development of this Means Test aims to provide a structured approach for the ADPC to evaluate applications for financial assistance. This tool is designed to identify applicants who would benefit most from support, ensuring equitable access to subsidies within the Arbitrum Ecosystem, particularly for smaller entities with valuable contributions.

The intent is to allocate subsidies to those most in need, avoiding exploitation by larger players looking for a ‘free lunch/handout’. Such an event could give recipients an unfair advantage over their competitors or be an inefficient use of the DAO’s funds if they do not bring about a net positive change.

The means test will include a scoring system ranging from 1 to 5, reflecting the merit of each application.

· Rating 1: Unsatisfactory

· Rating 2: Below expectations

· Rating 3: Meets expectations

· Rating 4: Above expectations

· Rating 5: Exceptional

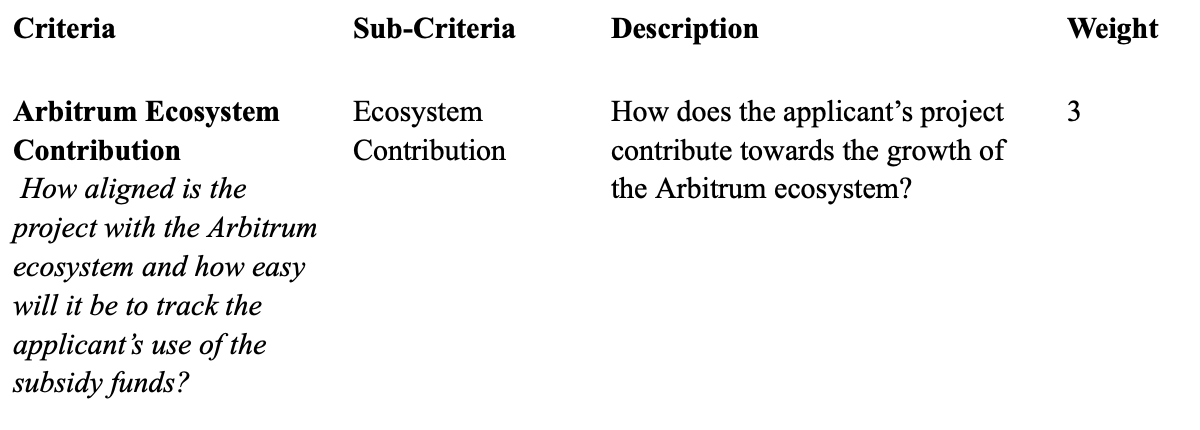

Each of the sub-criteria in the means test have varying levels of importance, and they will each have a weighting attached. A weighting of 1 indicates low importance, 2 indicates neutral importance, and 3 indicates high importance.

Each application will be scored by ADPC members, followed by a collective decision on the most deserving grant recipients, taking into account the rating against the eligibility criteria, a value-for-money evaluation and the funds available.

After the applications have been reviewed and decisions taken as to the grant beneficiaries, the average score assigned to each project will be shared publicly, ensuring that transparency is maintained throughout the process. In the event that an applicant receives a high score but is not chosen as a grant recipient, explanatory feedback will be provided either on an individual or collective basis to the cohort.

EVALUATION CRITERIA

Regarding the ‘Ecosystem Contribution’ metric above, we have conducted an initial assessment of the types of projects that are currently building in the Arbitrum ecosystem and identified a few verticals that the ecosystem would benefit from funding. These are set out below, along with the rationales for choosing them, providing more weight to such areas.

Note: We have removed the Collab Tech and Gaming verticals which were present in the original proposal. There are a number of grants programs already centered around Collab Tech, while the Gaming vertical is sufficiently incentivized via the GCP.

RWAs & Tokenization

· Commands a small proportion of Arbitrum attention and building however is a focus of big institutions & banks deploying large amounts of capital into tokenization.

· Arbitrum as the home of DeFi is currently trailing in this burgeoning key category (e.g., Mantle passed a $60 million support program for tokenized RWAs on their chain and Polygon and Avalanche have been very active in the space).

· Tokenized treasuries and private credit have passed $1.3 billion in terms of value tokenized, and are only projected to grow in importance in the near future, highlighted by the recent launch of BlackRock’s tokenized fund.

· Forum discussions talking about RWA’s being used as a tool for diversifying the Arbitrum DAO treasury. See here.

Stylus Adoption

· Stylus’s flexibility, as detailed in this proposal, allows developers to write smart contracts in Rust, C and C++, significantly expanding the developer base from an estimated 20,000 Solidity developers to include developers from other languages such as Rust and C++ which have around 3.5 million and 10 million developers respectively.

· Provides a more efficient execution environment compared to the EVM, resulting in over 10x cheaper computation and 100x cheaper memory usage. These improvements will lead to substantial gas savings for complex smart contracts, making previously impractical use cases feasible.

· Enables interoperability between Stylus and EVM contracts, allowing developers to call Rust programs from Solidity and vice versa, seamlessly integrating existing infrastructure such as Oracles with new Stylus-based contracts.

· Extends capabilities of the EVM without altering its core functionality, providing a long-term competitive advantage for Arbitrum by enabling higher throughput, lower costs, and supporting new use cases.

(B) Application Process

Application & Review Windows

The Subsidy Fund will run in 1 cohort of 8 weeks consisting of an initial submission period of 2 weeks, followed by a 6-week review period. This will operate on a first-come-first-served basis for application reviews.

Initial Screening

To efficiently handle the anticipated surge in applications and to ensure that the highest quality and most relevant applicants are selected, the below 5 sub-criteria (with the highest weights as mentioned above in the Means Test) will first be applied to all applicants, with the top-scoring applicants moving forward in the evaluation process and being assessed in greater depth:

1. Funding Gap Rationale

2. Reasonableness of Subsidy Amount Requested

3. KPIs

4. Ecosystem Contribution

5. Accountability Measures

In-Depth Review & Feedback

Projects that pass the initial screening will undergo a review due diligence (DD) by the ADPC, including interviews and constructive feedback (either individually or on a collective basis).

Award & Monitoring

Once approved, projects receive subsidies, with periodic check-ins and a concluding evaluation to measure impact and success.

(C) Selection Process & Reporting

Transparency and continuous dialogue form the backbone of our selection and reporting process, ensuring that each funded project remains aligned with program expectations.

Reports

We will provide updates on our selections and updates on funded projects. These updates will include general project trajectory and progress toward milestones. To create the reports we will set regular monthly check-in dates where projects fill a template/slide in order to give the key info about the project’s status, such as:

· Summary of Achievements for the Month

· Funds Utilized

· Milestones Reached

· Challenges Faced & Plan of Action

· Feedback Integration, i.e., how projects have incorporated feedback provided.

· Next Steps & Priorities

Output Metrics

With the initial priorities in mind, some effective measures for meaningful output will look as follows:

· Number of Projects Funded: Number of projects funded.

· Total Funds Allocated: Cumulative sum of funds distributed, showcasing the program’s financial impact.

· Percentage of projects funded in target verticals: As outlined in the Means Test, the two key verticals we have identified are RWAs & Tokenization and Stylus Adoption.

Outcome Metrics

Depending on the final portfolio of funded projects, we will gauge the success rate of awarded projects through specific outcome metrics. While these metrics can be influenced by a wide range of external factors, such as market conditions and individual decisions on a project level, we are committed to supporting and funding the most promising projects to the best of our ability. Metrics include:

· Percentage of funded projects successfully deployed on Arbitrum

· Percentage of KPIs outlined in the application achieved by funded projects

(D) Project Allocation

Our approach to subsidy fund allocation focuses on achieving high impact while ensuring that a de minimus number of projects obtain funding.

To ensure that the subsidy is spread across a large number of projects rather than concentrated in several larger projects, the maximum subsidy to be granted will comprise 10% of the subsidy fund available. Therefore, given that the subsidy fund comprises up to $2.5 million worth of ARB, the maximum subsidy that a project can receive will comprise no more than $250K worth of ARB.

(E) Team Setup

The administration and selection process of these subsidies will be managed by the ADPC. Even though the ultimate decision will lie with the judgment of the ADPC, their assessment will be strongly guided by a means test that evaluates key metrics to determine deserving projects.

The activation of the ADPC to manage the Subsidy Fund will hinge on extending the current 6-month mandate once the Subsidy Fund becomes operational. Should the DAO or the ADPC opt against a continuation of the ADPC, a Subsidy Fund Management Committee will need to be elected. The ADPC will allocate ample time for this process to ensure the Subsidy Fund operation is not reliant on the ADPC’s mandate extension.

(G) Governance

The Subsidy Fund governance aims for transparency, efficiency, and broad community involvement. It outlines mechanisms to ensure fair and balanced decision-making for all stakeholders.

Multi-Sig

All providers must undergo and successfully complete the standard Know-Your-Business (hereinafter referred to as the ‘KYB’) verification processes with the Arbitrum Foundation prior to receiving the service-subsidy.

Subsequently, the designated Multi-sig members, established at the inception of the ADPC and voted in favour of by the ArbitrumDAO, will take charge of disbursing funds to the selected beneficiaries, whereby the transactions will be streamed using Hedgey.

In recognition of the additional responsibilities undertaken, each of the five multi-sig wallets is proposed to receive a supplementary compensation ranging from 500 ARB - 1,000 ARB monthly.

It is also important to note, as per the ratified proposal which led to the formation of the ADPC, that the ArbitrumDAO has the authority to claw back funds from the ADPC’s multi-sig wallet using the Zodiac Governor Module, if necessary.

Flows of Funds

The $2.5m worth of ARB will be going to an Arbitrum Foundation controlled wallet (0x40FcE28C9f3a0d7B75B917C95960D61D930dCA54) to be converted to an ideal stablecoin via OTC trading, with the funds then being sent to the ADPC multi-sig as explained above. The flow of funds for the entire program can be understood via the diagram below, as outlined in the ADPC’s Security Services RFP forum post:

Checks & Balances

Kindly note that the subsidy fund will be subject to the same checks and balances found within the procurement committee proposal, regulated by an agreement entered into by all elected ADPC Members, with the Arbitrum Foundation serving as a counterparty to the agreement. These checks and balances include:

Conflict of Interest Provision: ADPC Members will be bound to act in absolute good faith, utmost honesty, refraining from deriving unauthorized profits from their position & disclose conflicts of interest. ADPC members should always disclose any potential or actual conflicts of interests to other ADPC members who will then proceed to mitigate the respective ADPC Members’ involvement in the task in relation to which such ADPC Member is conflicted.

To sum up, all ADPC Members must declare the nature and extent of any interest, direct or indirect, which the ADPC Member is aware that she, he or it has in a proposed task at hand.

Record-keeping and Reporting: Comprehensive and precise record-keeping is imperative. ADPC Members will be required to maintain detailed accounts and documentation of the ADPC’s internal operational workflow together with meeting minutes. Furthermore, periodic reporting is essential so as to keep the ArbitrumDAO updated re. Task-specific progress & internal ADPC Administration.

Duty of Impartiality: ADPC Members will have an obligation to act in an impartial manner in relation to their tasks & workflow, ensuring that the ADPC is not compromised by personal interests or external influences.

Obligation of Recusal: ADPC Members with a conflict of interest involving a project and/or service provider being reviewed by the ADPC should recuse themselves from participating in the evaluation, facilitation & administration of the applicable procurement process.

Prohibition of Self-Dealing: Participants should refrain from voting on sending funds to themselves or organizations where any portion of those funds is expected to flow to them, their other projects, or anyone they have a close personal or economic relationship with.

Ethical Trading: Members are required to follow ethical trading standards concerning ARB and any other relevant digital assets.