Uniswap Growth Program Trial

Full Forum Post: Here

Authors

AlphaGrowth and our sister company ReservoirDAO are DAO service providers primarily working in the realm of DeFi growth through grants, BD, growth-marketing, and DeFi Operations. Our marquee partner is Compound.Finance, where we run all things growth, business development and marketing for the DAO.

Co-authors for Uniswap Ecosystem Incentives Initiative section

Uniswap MetaGov Team: @PGov and @AranaDigital; The team first formed as the UADP to focus on Arbitrum’s governance and ecosystem. After applying and receiving 1M ARB in grants for the Uniswap DAO, it was deployed over 3 months and recently concluded. With this success, the UADP, now MetaGov team, is looking to deploy this framework across other chains. The team consists of long-time community members and delegates who have participated as contributors through multiple working groups and have worked across various committees and grant programs in Uniswap and across DeFi.

How we got here

Over the last few market cycles, we cut our teeth in the world of grants, BD, go-to-market, tokenomics, and ecosystem growth. We’ve helped dozens of projects go multichain. Throughout this process, members of Compound DAO encouraged us to design and implement a comprehensive growth program to address stagnation in the protocol. As of today, we lead growth for Compound.Finance.

Here is the most recent quarterly report on our growth program at Compound. For a comprehensive view of AlphaGrowth-led Compound Growth Program, check out this Dune Dashboard.

What’s the problem?

Currently, there is little outbound business development. Uniswap Labs is not currently focused on expanding the protocol to new chains, creating an opportunity within the DAO. Additionally, the UAC has done an exceptional job in facilitating the middle of the pipeline. However, to continue scaling Uniswap’s impact and user base, there is a growing need to strengthen the initial and final stages of the business development process.

Uniswap lacks a structured outbound business development strategy, limiting new chains and strategic partnerships. This reliance on inbound interest restricts Uniswap’s growth. Without outbound, valuable opportunities are being missed, and Uniswap risks falling behind competitors who take a more aggressive approach in pursuing partnerships and integrations. The current reactive approach slows expansion into new markets and ecosystems.

Teams like Oku are often marketing new deployments and incentives on their own—efforts that could be amplified by the Uniswap ecosystem if a mechanism were in place. At present, the lack of a standardized process for co-marketing initiatives is causing missed opportunities for growth.

We’re leaving incentives on the table.

Although Uniswap is live on over 25 chains, we aren’t currently capitalizing on the numerous incentive programs that are up for grabs. Without a team dedicated to securing and effectively distributing these funds, valuable opportunities for growth and user acquisition are being missed out on. Here are some concrete examples:

- Optimism Grants Council: Potential to secure ~$1 million each year in incentives for Uniswap users

- Scroll: Recently closed applications to a grants program awarding six figures to ecosystem projects

- Chains like Taiko, Mantle, Rootstock, Boba, and Linea offer incentives that Uniswap is eligible for but not is taking full advantage of.

- Other chains have expressed interest in creating one-off grants for incentivizing activity within their ecosystems

- Projects including Circle (USDC) have spoken to us about ways to incentivize utilization, but channels for doing so are currently unclear to them.

What solutions do we propose?

Our plan of action includes an outbound business development team, a dedicated marketing team, and a team committed to securing grants and incentives for Uniswap users.

A Dedicated Outbound Business Development Team

To maximize opportunities at the top of the funnel, we will deploy our crypto-native team to spearhead outbound business development for the Uniswap Protocol. The objective is to consistently deliver high-quality opportunities to the UAC and the DAO, streamlining and enhancing the current process.

With this proactive strategy, we will engage new opportunities before our competitors do. This is crucial in sustaining Uniswap’s leadership position in the DeFi space.

Our team will work closely with the UAC, Oku, and others to identify the best opportunities to prioritize the roadmap for future Uniswap deployments. Some of these targets include new chains and integrations like wallets and bridges. Our immediate focus includes targeting the various new EVM chains launching on the horizon, in addition to the abundance of opportunities within the OP Superchain and Arbitrum Orbit. Further, as the Uniswap v4 rollout is iterated upon launch, we will work hand in hand with relevant stakeholders to ensure target chains are aware of v4’s value proposition. This may include DeFi, CeFi, and TradFi.

To further support our DeFi BD team over the years, we’ve built a Telegram-native CRM specifically designed to manage growth efficiently and effectively. We’ll touch more on this later.

A Dedicated Marketing Team

To ensure these new opportunities and incentives are shared far and wide, we propose leveraging our growth-marketing team. As we secure these grants and incentives, our mission is to strategically promote and distribute this alpha across the DeFi space, increasing TVL, volume, and activity on Uniswap.

Based on the success we’ve had running campaigns around the distribution of millions in incentives to Compound users, the primary marketing channel we recommend is Twitter. Promoting engaging content will help mitigate the cold-start problem of building a following. Additionally, ensuring visibility on industry-leading platforms such as CoinMarketCap and CoinGecko will keep Uniswap top-of-mind for ideal audiences. If there are other channels that the DAO would like to see activated, we are more than happy to entertain these options.

Further, we will work with Blockchain Ads, one of our tried and true partners, to facilitate targeted marketing efforts. Together we will leverage on-chain data to reach high-value wallet owners. To maximize engagement, we’ll also leverage Layer3’s interactive quests to gamify onboarding and increase user awareness and retention.

Over the past year, the DAO has approved the deployment of Uni V3 on over a dozen EVMs, but there has never been a DAO-led push to ensure that individuals outside of the DAO are aware of these deployments and the incentives that accompany them. We will act as that bridge between the DAO and the broader DeFi community. Our job is not to make up new stories, but to curate, manage, and amplify the stories that already exist inside the Uniswap ecosystem.

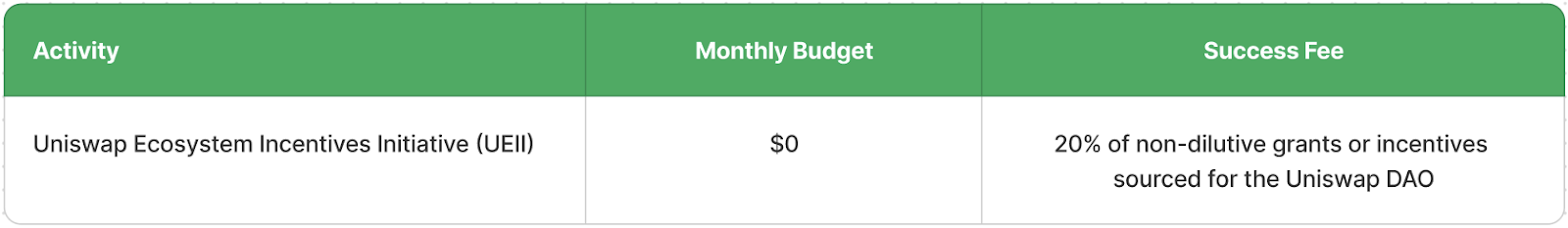

Uniswap Ecosystem Incentives Initiative (UEII)

We will be working together with @PGov and @AranaDigital on the UEII (Initial post here: UEII). Their team first formed as the UADP, focusing on Arbitrum’s governance, applied and received a 1M ARB grant for the Uniswap DAO a few months ago. This grant was deployed over 3 months and recently concluded. With this success, the UADP, now MetaGov team, is looking to deploy this framework across other chains. Together, with our team at AlphaGrowth, we propose leveraging our dedicated team to distribute the most value to Uniswap users and help the Metagov team, focusing on securing grants and incentives for the DAO and Uniswap users.

The initial focus will be on chains where Uniswap is currently deployed, capitalizing first on the lowest-hanging fruit. Depending on the goals of the issuing partners, these grants and incentives can be distributed in several ways: allocated to liquidity providers on specific chains / liquidity pools (e.g., stablecoins, LSTs, LRTs), used to subsidize transaction costs and trading fees, or directed toward other creative initiatives.

When reaching out to prospective chains, the UEII team will leverage our experiences and contributions across these chains as all of us are already involved across different target ecosystems. We’ll utilize existing DAO programs like the Uniswap Onboarding Package to strengthen our claim and pitch, working hand in hand with each chain to secure the maximum incentives possible for the DAO.

Oftentimes these grants require KYC/KYB, which we’ll handle through ReservoirDAO, AlphaGrowth’s sister company DAO LLC in the Marshall Islands. This is how we’ve successfully claimed and distributed incentives for Compound as we’re fully doxed and ready to facilitate the process.

Trial Period

Given the long sales cycles associated with business development, marketing, and grant sourcing, we are proposing a 6-month trial period for this program. These initiatives will require time and space to cultivate impactful relationships and attain measurable results. 6 months will provide a reasonable window to build momentum and gather meaningful insights, while still leaving room for any necessary strategic adjustments.

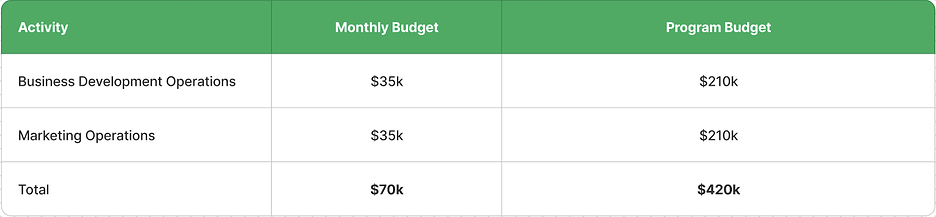

Budget Request

Note: If the images aren't loading, please refer to the forums.

Note: If the images aren't loading, please refer to the forums.

Funds will be sent to the Uniswap Accountability Committee. $420k will be then sent to AlphaGrowth. For the UEII, since we do not know exactly how much in grants we can secure for the DAO, a $500k “reserve” has been set side for the UEII success fee. This “reserve” will be held in the separate DAO trusted entity (UAC), and the UAC will NOT send funds for the UEII until grants and incentives have been sourced for the DAO. This should reduce governance overhead from having to vote in funding each time and ALL remaining “reserve” funds after the 6 month trial period will be returned to the DAO.

A forum thread updating the community on each UEII sourced grant and distribution/program specifics will be created and continuously updated.

UNI Price at vote: $7.49