[NON-CONSTITUTIONAL] Arbitrum DAO Procurement Committee: Phase II Proposal

Arbitrum DAO Procurement Committee: Phase II Proposal

Contents

I. Executive Summary

II. Background of the ADPC

III. Achievements & Progress

IV. Key Learnings & Improvements from Phase I

V. Phase II Mandate

VI. Budget & Methodology

VII. Methodology for Shortlisting Verticals for Phase II

VIII. Transparency & Community Engagement

IX. Checks & Balances

X. Multi-Sig

XI. ARB Conversion Strategy

I. Executive Summary

Background

The Arbitrum DAO Procurement Committee (”ADPC”), composed of Axis Advisory, Areta, and Daimon Legal, is coming to the end of its first phase on August 20, 2024. As such, this proposal aims to extend the ADPC’s tenure into Phase II for a 6-month period, which will commence on the date on which the Tally vote for this proposal is executed on-chain.

Outcome

The ADPC’s pilot phase proceeded successfully, with significant outcomes to Arbitrum DAO and a range of key learnings for the committee. Creating a comprehensive procurement process from the ground up to ensure that Arbitrum is seen as a leader not only in the technical sphere but also within decentralized governance has been a great opportunity.

We laid the foundation for the ADPC to be an effective set-up bringing the benefits of well-structured procurement to Arbitrum DAO. Cost savings will result from the creation and use of procurement frameworks and marketplaces developed by the ADPC uniquely for Arbitrum DAO as well as the necessary legal and operational infrastructure and strategic sourcing methodology.

Way Ahead

The ADPC's initial phase was conducted as a proof of concept demonstrating the capability of the team and the benefits arising from the strategic use of advanced sourcing methodology. The ADPC proposes to build on these successes into Phase II of the ADPC's engagement. In this Phase II, the ADPC, after careful alignment with key stakeholders in the DAO, proposes to work on all of the following work packages:

1. Work Package 1: Procurement for 2 tactical verticals

- Vertical 1 will be focused on procuring RPC providers for projects building in the Arbitrum ecosystem. This decision is based on engagement with delegates and stakeholders as well as an understanding of the core services required by all projects looking to build in the Arbitrum ecosystem.

- Vertical 2 will be focused on providing the procurement services for events identified within the DAO Events Strategy for 2025. This event strategy is prepared by the ADPC, Entropy Advisors and Disruption Joe pursuant to a separate proposal. Please note that the ADPC will not request any funding for its events services procurement in that separate proposal.

- The scope within the 6-month term is to develop evaluation criteria, draft and publish the Approach to Market (RFP/tender), evaluate responses to Approach to Market and whitelist supplier/s. Contract negotiations with whitelisted suppliers are not in the scope as the counter-party may be the Arbitrum Foundation or third parties utilizing their own counsel, and the ADPC has no influence on those internal legal processes.

- Further details on our process for arriving at these shortlisted verticals can be found below in the section on Methodology for Shortlisting Verticals for Phase II.

2. Work Package 2: Continued management of the Subsidy Fund for Security Services and, based on the success of the first cohort, publishing the proposal for an extension of the fund.

3. Work Package 3

- Definition and creation of an Operational Expense (OpEx) budget for the Arbitrum DAO, to be custodied by the Multi-Signature Safe (MSS), and allocated towards the utilisation of service providers as whitelisted by the ADPC. This creates a utilisation rail for the DAO to be able to utilise the services of the whitelisted service providers procured by the ADPC. Without this in place, the DAO is unable to utilise these service providers without the full proposal process (Forum, Snapshot, On-Chain).

- The ADPC will draft and propose the OpEx proposal to the DAO; further details, including the process and procedure for utilization of the OpEx budget by the DAO, will be outlined in this separate proposal to the DAO. This seperate proposal will contain multiple options for the size of the OpEx budget for the community to vote on.

4. Work Package 4

- Creating a Phase II Outcome Report, similar to the one we have [published](https://docsend.com/view/b25g3iu6feppm7as) for Phase I, and submitting it to the DAO.

- Continued alignment with key stakeholders in the DAO on the evolution of the Arbitrum DAO’s structure, and ensuring that the ADPC fits into any structure that is defined (e.g., OpCo).

- Ad-hoc tasks, e.g., aligning and connecting whitelisted service providers with existing and incoming projects on Arbitrum, existing and incoming DAO proposals, etc.

5. Optional Additional Verticals: On completion of Work Package 1 and subject to (i) DAO demand and (ii) capacity of the ADPC at that point, procurement for up to [2] additional verticals on request from the DAO after approval by the DAO governance process. Where the procurement for such additional verticals is likely to require an extension to the ADPC term, this Work Package will be contingent on that renewal being granted by the DAO to avoid partial completion of tasks.

The overall budget for the 6-month term will be USD 414,000 including OpEx, details on which can be found below in the Budget & Methodology section. The Funding Request from the on-chain vote will be 954,608 ARB based on the time weighted average ARB price of $0.5204/ARB as further outlined below. A buffer has been added so that, in the case of ARB depreciation, the ADPC multi-sig under the Multi-Sig Service (MSS) is still able to satisfy payments to the ADPC's members. Unutilized ARB will be returned to the Arbitrum DAO treasury.

The multi-sig requested to manage the funds is within the Multi-Sig Support Service (MSS) established by Entropy Advisors. The Multi-Sig that has been created by the MSS is the following address:

arb1:0x13d4Ff2A83fBCB8F5fc73cE66CF5928eD0943cB0

After receipt of the ARB, the ADPC will convert as much of the requested amount as is required to obtain 414,000 USDC and will return the unutilized ARB to the DAO treasury. This is intended to avoid fluctuations in ARB price and ensures that the ADPC avoids using the buffer as much as possible.

The ADPC will utilize a Protocol-Owned Execution strategy on Gauntlet's Aera solution to convert the program’s ARB into USDC for operational purposes. The Protocol-Owned Execution strategy utilizes off-chain logic to monitor on-chain liquidity and model the price impact of trading. The ADPC will use an Aera Vault, with Gauntlet as the guardian, to execute the conversion. Trade execution is scheduled and sized according to impact modelling and executed on Odos, or Bebop. Based on current market conditions, it would take approximately one week to trade out of 414K USD worth of ARB with minimal impact.

Once the ARB is converted into USDC, the Aera vault will utilize LlamaPay to stream the total payment due to the ADPC member wallet addresses over the course of the 6-month period (120k USDC per member, 360k USDC in total). The remainder of the converted funds (54k USDC) will remain in the MSS as the OpEx budget. This process will be coordinated with the MSS chairs and members.

Further details about the ARB conversion strategy and about Aera can be found below in the 'ARB Conversion Strategy' section below.

Note: The proposal includes the re-election of the current members of the ADPC. For any future extension terms of the ADPC, the process outlined in the original Tally vote will stand unless automatic renewal of the then-current members is proposed. Of course, this will be subject to the potential OpCo that gets formed and any implications that may have on the structure of the ADPC.

Acknowledgements

We would like to acknowledge the consistent participation and deep input from the Arbitrum community, delegates, and stakeholders, without whom our progress would not have been possible. We would especially like to thank the security service providers who deeply engaged with the program from the very beginning. We would also like to thank all respondents to the ADPC’s outreach in determining the procurement frameworks to tackle in Phase II, including @bobbay, @JoJo, @Frisson, @realdumbird, @IronBoots, and @krst, among others.

II. Background of the ADPC

The ADPC was established as a crucial component of the Arbitrum ecosystem's governance structure, following a successful proposal and subsequent community vote in early 2024. The formation of the ADPC was driven by the growing need for a structured, transparent, and efficient approach to procurement within the Arbitrum ecosystem, ultimately contributing to the ecosystem's growth, security, and sustainability.

The inception of the ADPC can be traced back to discussions within the Arbitrum community about the challenges faced by projects building on the protocol, particularly in securing high-quality service providers. These discussions highlighted the need for a pre-emptive quality assurance mechanism that could benefit the entire ecosystem. Against the background that a dedicated procurement framework has, to our knowledge, not been established in any DAO prior, the committee's formation marked a pivotal moment not only in Arbitrum's governance evolution, but set a precedent for DAOs in general. We designed the ADPC to address immediate needs and to create a foundation for future growth and efficiency in the ecosystem.

Phase I of the ADPC ran for a duration of 182 days from February 21, 2024 (i.e., the day that the KYB for the ADPC members was completed) until August 20, 2024.

The ADPC’s mandate in Phase I consisted of the following:

A. Oversight of Security-Oriented Service Providers Framework

Oversee and facilitate the Procurement Framework for security-oriented service providers within the Arbitrum Ecosystem.

B. Subsidy Fund Research & Proposal

Research and draft a proposal to set up a subsidy fund for security-oriented services to subsidize the costs for security services for smaller projects within the Arbitrum Ecosystem.

C. Development of Eligibility Framework (’Means Test’)

Research and implement a framework that will establish a set of qualitative & quantitative metrics that will be utilized to assess a project's eligibility for the subsidy fund referred to in paragraph [B] above.

D. Establishment of Future Procurement Frameworks

Establish procurement frameworks for a myriad of verticals/service types that the Arbitrum DAO could need in the foreseeable future.

E. Creation and Communication of Guidance

Create and communicate guidance notes & circulars that will substantiate & provide additional detail in relation to any procurement framework that is ratified by the ArbitrumDAO from time to time.

III. Achievements & Progress

The ADPC made significant progress against its mandates:

A. Oversight of Security-Oriented Service Providers Framework

The ADPC finalized and published extensive RFP documentation for whitelisting security service providers on June 19, 2024. This comprehensive framework is designed to establish a marketplace for whitelisted service providers to offer services pursuant to pre-agreed terms, conditions, and pricing to projects that have been granted subsidies under the Security Services Subsidy Fund Proposal.

The development of the RFP documentation was an intensive, multi-stage process that involved various stakeholders and multiple rounds of refinement. The key stages included:

- Creating an initial draft that incorporated research on best practices in procurement frameworks and multiple internal drafting sessions;

- Working with DeDaub to integrate specific technical requirements into the RFP;

- Working with the Arbitrum Foundation’s legal team to align the legal documents with the Foundation’s policies and guidelines;

- Conducting a final review by the ADPC, DeDaub, and the Arbitrum Foundation;

- Publishing the final documentation.

This procurement framework, being the first of its kind, set a new standard for procurement processes in the crypto space.

The RFP received responses from 12 security service providers and the whitelisting of these providers is still in progress. We expect to execute the agreements necessary for enabling engagement in September 2024.

B. Subsidy Fund Research & Proposal

The ADPC researched, drafted, and passed a proposal to set up a subsidy fund for security-oriented services; the development of the proposal was strongly influenced by community engagement, while the terms and conditions for the receipt of the subsidy (’Means Test’) were mainly based on our experience from traditional procurement processes.

The initial Subsidy Fund proposal incorporated:

- A comprehensive benchmarking exercise with 10 leading security audit service providers which was conducted to analyze costs and scope of typical security audits to determine the fund size and allocation;

- A detailed evaluation framework with weighted criteria for the ‘Means Test’; and

- Timelines and procedures for application submission and review.

Following the publication of the initial proposal, the ADPC engaged in extensive community discussions. Key points of feedback included concerns about the large fund size and potential for inefficient capital allocation and questions about the capacity to manage such a large fund.

In response to community feedback, the ADPC revised the proposal. In particular, the subsidy fund was reduced to $2.5 million worth of ARB (75% reduction) to potentially fund up to 12 projects for one cohort of 8 weeks and with a maximum subsidy per project of $250K (10% of the total fund).

The ADPC also listened to and incorporated community feedback about the ADPC managing the initial subsidy fund itself. As a consequence, the ADPC translated raised community concerns into a concrete governance proposal to create a separate “Security Services Subsidy Fund Sub-Committee”, consisting of five members elected through a weighted voting system with a proposed compensation of 60,000 ARB in total. However, after thorough discussion, the community voted against the creation of the sub-committee, leaving the disbursement of funds under the subsidy fund to the ADPC.

C. Development of Eligibility Framework (’Means Test’)

The Means Test and the related Grant Application T&Cs were uniquely developed for Arbitrum DAO as a structured approach to evaluate applications for financial assistance. The primary goal of the Means Test is to identify applicants who would benefit most from support with the potential for significant positive impact on the Arbitrum ecosystem while (i) ensuring equitable access to subsidies within the Arbitrum Ecosystem and (ii) preventing exploitation by larger players.

For this assessment, we:

- Developed a scoring system with a 1-5 rating scale and assigned weights to criteria based on importance.

- Developed four main criteria categories, each with weighted sub-criteria: Arbitrum Ecosystem Contribution, Business Model & Need for the Subsidy, Financial Analysis and a Risk Analysis.

- Based on community feedback, we further identified key verticals that are particularly valuable to the Arbitrum ecosystem.

- Implemented a two-stage evaluation process, with an initial screening focused on the five highest-weighted sub-criteria before conducting an in-depth review with a comprehensive evaluation of all criteria for top-scoring applicants.

D. Establishment of Future Procurement Frameworks

While our primary efforts were focused, due to the complexity of the undertaking and the high level of community engagement and input, on the oversight of the security-oriented service providers framework, the research and proposal of the subsidy fund, the development of the eligibility framework ('Means Test') and the creation and communication of guidance, we did conduct work to identify and prioritize potential verticals for future procurement frameworks. Our approach was to create a comprehensive and adaptable methodology that could be applied to various service categories, ensuring that future frameworks would be developed with a robust approach.

More detail about our exploration into future procurement frameworks can be found in the section on Methodology for Shortlisting Verticals for Phase II below.

E. Creation and Communication of Guidance

The ADPC achieved its goal of keeping the community abreast of its activities and progress during the entirety of its first phase by:

1. Setting up a bi-weekly 1 hour call on the Arbitrum governance calendar to engage with delegates and community members;

2. Establishing a dedicated dashboard including the Meeting Minutes of each week’s internal ADPC standing meeting and the ADPC’s current task list;

3. Creating a dedicated Telegram channel to communicate with RFP applicants;

4. Scheduling two AMA sessions to field and answer queries from RFP applicants; and

5. Publishing a forum post explaining how the entire Procurement Framework operates.

IV. Key Learnings & Improvements from Phase I

A comprehensive set of learnings and recommendations can be found in the ADPC’s Phase I Outcome Report. A subset of the most important of these learnings that we will implement in Phase II are:

Financial Management & Budgeting

Given the nature of this initial phase being a pilot, the budget for Phase I was more ‘experimental’, and thus did not fully account for all necessary resources. As such, this proposal will include a comprehensive budget plan and management that:

- Creates a fit-for-purpose budget model based on data collected during Phase I; this model is further explained in the Budget & Methodology section below;

- Bakes in Operating Expenses to account for unexpected challenges and opportunities;

- Allocates budget for specialized external consultants to address complex issues efficiently (such as DeDaub in Phase I); and

- Increases the number of FTE personnel to adequately cover all aspects of the ADPC's mandate.

Clear Alignment with Arbitrum Foundation

To improve effective coordination with the Arbitrum Foundation, in Phase II we will:

- Designate specific points of contact within both the ADPC and the Arbitrum Foundation for different areas of collaboration (e.g., legal, technical, strategic). As needed, the points of contact will be with the DAO Relations team;

- Establish regular check-in meetings between the ADPC and Arbitrum Foundation;

- Implement a clear escalation path for urgent matters or deadlocks;

- Develop a mechanism for early Foundation review of legal frameworks;

- Coordinate timelines for legal reviews and feedback.

Create a Long-Term Vision for the ADPC’s Role in Supporting Arbitrum

As can be seen in the Methodology for Shortlisting Verticals for Phase II section below, we have already begun to identify a list of selected procurement frameworks the ADPC can tackle over its next and future phases. To compile this list, we used a comprehensive methodology, involving community feedback and engagement, and took into account current market conditions and need for Arbitrum.

In Phase II, we will further outline the ADPC’s role in the continued growth of Arbitrum and ensure that it forms an important part of the DAO’s structure going forward, including as a key component of the OpCo.

Community Engagement & Transparency

While we spent significant time and resources on community engagement and providing regular, detailed updates, this part of our mandate was more time-consuming than anticipated but crucial for the success of initiatives. Key learnings that we will implement in Phase II are to:

- Implement a clear process for incorporating community input into decision-making;

- Improve the public dashboard to inform better about the ADPC and showing even more information on real-time progress;

- Develop comprehensive onboarding materials for community members interested in ADPC activities.

V. Phase II Mandate

The ADPC proposes the following work packages in Phase II:

Work Package 1: Procurement for 2 Tactical Verticals

Vertical 1. Procuring RPC Providers

Vertical 1 will be focused on creating a whitelisted panel of RPC providers that can be procured by projects currently building or looking to build on Arbitrum. This panel of RPC providers will enable streamlined access and transparent pricing during the project’s build phase or post-launch, adding to the ecosystem of support services for Arbitrum projects and Orbit chains.

We have chosen this vertical based on discussions with key delegates and stakeholders, given that a key focus for Arbitrum is to grow the Orbit ecosystem, while RPC costs are relatively high and RPCs are critical for projects to deploy, similar to security audits. Moreover, the technical due diligence around infrastructure providers is a huge time suck for projects. Pre-vetting RPC providers would make it much more attractive for projects to build on Arbitrum.

In case there is any major opposition to the selection of this vertical, the ADPC will in the first month of Phase II engage with key delegates and stakeholders to arrive at a final decision on the vertical to tackle. The stakeholders we have engaged with have demonstrated an interest in each of the verticals listed below. To find such a substitute vertical, we will:

- Shortlist key stakeholders to schedule calls with;

- Liaise with the Arbitrum Foundation to identify relevant legal and regulatory considerations associated with these frameworks;

- Create engagement surveys to be shared with key delegates and projects building on Arbitrum to identify their one prioritized vertical from the below four verticals:

For further information on the methodology we used to shortlist these frameworks, see the Methodology for Shortlisting Verticals for Phase II section below.

Vertical 2. Procuring Events Providers

Vertical 2 will be focused on providing the procurement services for events identified within the DAO Events Strategy for 2025. This event strategy is prepared by the ADPC, Entropy Advisors and Disruption Joe pursuant to a separate proposal.

The selection of event provider(s) will follow a two-step process: Together with the ADPC, Entropy Advisors will first create an events & sponsorships strategy while, in parallel, event providers will be whitelisted. Second, individual RFP processes will be conducted to procure event services for specific events defined in the event strategy from the whitelisted panel.

Please refer to the “RFP - Establishing a DAO Events Strategy for 2025” proposal for granular detail on how this procurement process will be constructed when it is published in the coming weeks.

Scope for Work Package 1

The scope within the 6-month term is to:

- Develop evaluation criteria;

- Draft and publish the Approach to Market (RFP / tender);

- Evaluate responses to Approach to Market and whitelist supplier/s.

- If need be, research and begin the process of setting up a subsidy fund for the RPC providers vertical (or, if the need arises, a substitute vertical chosen by the DAO). This will include the development and ratification of the Means Test for that specific fund, community engagement and research to determine the size of the fund, drafting a proposal to pass the fund through Arbitrum governance, and if need be, the set-up of a separate sub-committee to manage the fund.

- For the Events vertical, conduct individual RFP processes to procure event services for specific events defined in the event strategy from the whitelisted panel.

Note:

- Contract negotiations with whitelisted suppliers are not in scope as the counter-party may be the Arbitrum Foundation or third parties utilizing their own counsel, and the ADPC has no influence on those external parties.

- To streamline our financial budget, the management of any subsidy fund other than the legacy subsidy fund for security service providers is not included in this scope. The management of newly formed subsidy funds could be conducted either by a separate sub-committee or by the ADPC (as decided upon by the DAO), and will be subject to an additional management fee which will be included in any extension proposal.

Work Package 2: Management of the Subsidy Fund for Security Services

Scope for Work Package 2

- The management of the Security Services Subsidy Fund was not part of the ADPC’s mandate in Phase I. However, as decided by the DAO, the ADPC was elected to manage the first cohort of the Subsidy Fund, which we hereby include in the scope for this work package.

- Communication of key learnings and improvements from the first cohort of the Subsidy Fund.

- The ADPC will conduct in particular the following tasks to manage the Subsidy Fund (non-exhaustive):

- Setting up the infrastructure for running the program;

- Defining and executing the marketing strategy;

- Scanning inbound applications, filtering for scams/junk, and reviewing each application;

- Onboarding of grantees, including a welcome email with acceptance, set up of comms channels, coordinating KYB/KYC, etc.

- Setting milestones for funding and progress;

- Ensuring milestone alignment with program objectives;

- Setting clear project deliverables;

- Tracking progress;

- Executing funding alongside the Arbitrum Foundation;

- Preparing the End-of-Program report;

- Act as the point of contact and ‘customer service’ for all grant applicants.

- Depending on the success of this first iteration, market conditions, and demand from the DAO, the ADPC may propose an extension of the fund for one or more cohorts.

- Depending on discussions with the community and delegates and learnings from the first iteration of the fund, the ADPC will either propose a separate sub-committee to manage the fund or will propose to manage the next iteration of the fund itself. Both of these options will require additional fund management costs which will be included in any Subsidy Fund extension proposal.

Work Package 3: Creation of OpEx (Operational Expense) Budget for the DAO to Utilize Whitelisted Service Providers

Objective

The Arbitrum DAO currently faces significant inefficiencies in its ability to engage with service providers, particularly those whitelisted by the ADPC. Presently, any effort to solicit services, such as a security audit, requires the DAO to navigate the entire governance proposal life cycle — a process that can extend over a month for just a single deliverable. This protracted timeline not only delays critical operations but also impedes the DAO's ability to respond swiftly to emerging needs, creating a bottleneck that hinders operational efficiency.

To address these inefficiencies and better equip the DAO for future needs, we will propose the establishment of an Operational Expense (OpEx) budget. This budget is designed to streamline the DAO’s interaction with ADPC-whitelisted service providers by creating a direct utilization rail. This rail will allow DAO initiatives and contributors to access and utilize these pre-approved service providers without undergoing the cumbersome proposal process for each engagement. The OpEx budget essentially bypasses the bureaucratic hurdles that currently plague the DAO’s procurement process, enabling a more agile and responsive operational framework.

The OpEx budget will be initially administered by the Multi-Signature Service (MSS), ensuring that funds are allocated specifically for the utilization of ADPC-whitelisted service providers. The ADPC will draft the initial proposal for the OpEx budget, which will include detailed guidelines on its usage. Importantly, while the ADPC will establish the budget, it will not have control over its management or the approval of expenditures, thus maintaining a clear separation of duties and preserving DAO oversight.

Why is an OpEx Budget Needed?

Currently, the DAO’s engagement with service providers is hampered by a rigid and time-consuming process that involves submitting a governance proposal, conducting a Snapshot temperature check, and finally, holding an on-chain vote. This multi-step process is not only inefficient but also stifles the DAO’s ability to procure services in a timely manner, particularly in scenarios requiring quick action. By introducing an OpEx budget, we aim to eliminate these bureaucratic barriers, creating a streamlined pathway for the DAO to access necessary services from ADPC-whitelisted providers.

Moreover, the OpEx budget is not just a temporary fix; it is a strategic initiative designed to future-proof the DAO’s operations. As the DAO evolves, the OpEx budget can be seamlessly integrated into future organizational structures, such as the prospective OpCo, which has been under discussion. By establishing this budget now, the DAO ensures it has a ready-made, adaptable infrastructure in place to meet its future operational needs. This forward-thinking approach not only addresses current inefficiencies but also lays the foundation for a more resilient and responsive organizational framework.

Key Aspects of the Proposal

- Funding Allocation: The amount allocated to the OpEx budget will be determined through a governance vote, with the ADPC providing multiple options for consideration. The funds will be held in the Multi-Sig Service (MSS) set up by Entropy Advisors, dedicated exclusively to services procured through the ADPC’s whitelisted providers.

- Effective Utilization: The proposal will outline the procedures for the DAO to efficiently utilize the OpEx budget, ensuring that all expenditures are subject to appropriate oversight while still allowing for the flexibility needed to address immediate operational needs.

Benefits of the Proposal

- Immediate Access: The OpEx budget will enable the Arbitrum DAO to quickly and efficiently engage with service providers without the delays imposed by the current governance process.

- Foundation for Future Operations: This initiative serves as a foundational step toward future-proofing the DAO’s operations. By establishing relationships with service providers now, the DAO will be better positioned to transition into more complex organizational structures in the future, with an established operational framework already in place.

In summary, the introduction of an OpEx budget addresses the current inefficiencies in the DAO’s procurement process by providing a streamlined mechanism for engaging with service providers. It also future-proofs the DAO by laying the groundwork for its evolving operational needs, ensuring that the DAO can continue to operate efficiently and effectively as it grows and adapts.

Work Package 4: Outcome Report, Definition of ADPC Vision and Role, and Ad-Hoc Tasks

Scope for Work Package 4

- Creating a Phase II Outcome Report, similar to the one we have published for Phase I, to be submitted to the DAO. The Outcome Report will consist of:

- Achievements and Progress from Phase II;

- Financial Overview;

- Overview of Community Engagement;

- Challenges;

- Key Learnings & Recommendations;

- Outlook.

- Continued definition of ADPC vision and role in the DAO:

- The DAO is currently in the process of determining its ways of working and operational structure for the short and long-terms. There have been extensive discussions among key delegates and community members around the set-up of an OpCo, and Areta has (tentatively) defined how the ADPC could fit into such a structure in the final report for the M&A Pilot Phase.

- As such, as part of the ADPC, we commit to continually align with key stakeholders in the DAO on the evolution of the Arbitrum DAO’s structure, and ensuring that the ADPC fits cleanly into any structure that is defined (e.g., OpCo).

- Executing on ad-hoc tasks such as aligning and connecting whitelisted service providers with existing and incoming projects on Arbitrum, existing and incoming DAO proposals, etc.

Optional Additional Verticals: Procurement for Up to [2] Additional Verticals Depending on the Completion of Work Package 1

Scope of Optional Additional Verticals

On completion of Work Package 1 and subject to (i) DAO demand and (ii) capacity of the ADPC at that point, procurement for up to [2] additional verticals on request from the DAO after approval and approved by the DAO governance process. Where the procurement for such additional verticals is likely to require an extension to the ADPC term, this Work Package will be contingent on that renewal being granted by the DAO to avoid partial completion of tasks.

We are leaving some flexibility in this Work Package given the pace of change in the DAO and the broader crypto market, and recognize that the DAO’s needs and wants will likely change over time.

Note: This work package will likely be subject to the ADPC requiring additional funding since this Phase II proposal is based on conducting procurement for two verticals. If the need for additional funding to conduct procurement for these further verticalsarises, the ADPC will approach the DAO with further details about budget and scope.

VI. Budget & Methodology

Budget Components

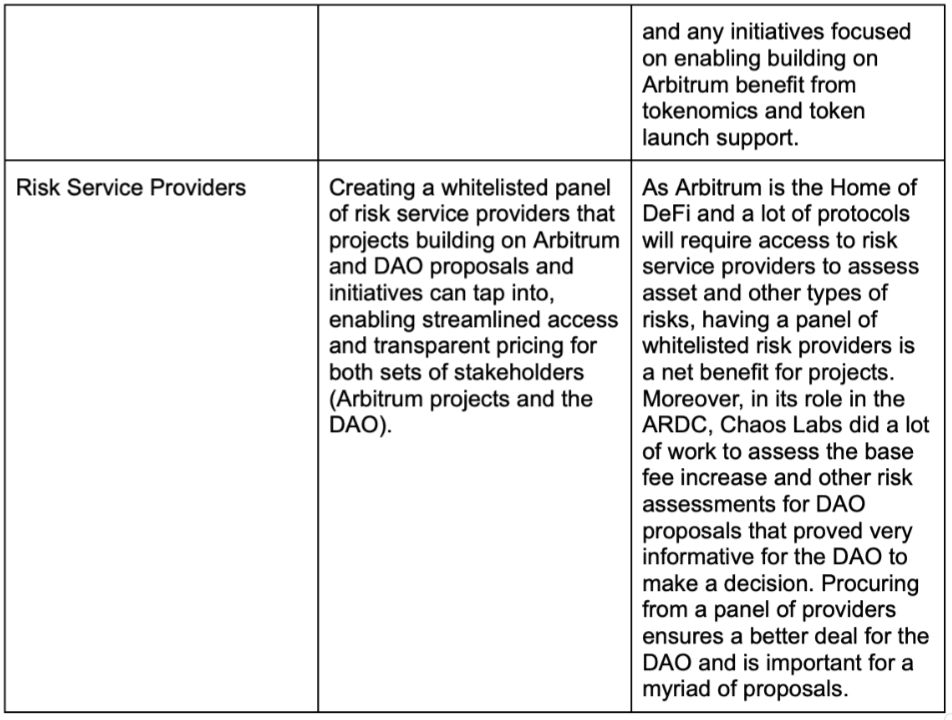

Phase II Budget

As outlined in the Phase I Outcome Report and the section on Key Learnings & Improvements from Phase I above, the actual work in the ADPC was significantly more time intensive than priced-in, but taken on by the committee as goodwill in the pilot phase. Since we have now left the pilot phase and will provide procurement services for two verticals in Work Package 1, the budget naturally reflects this.

The ADPC is budgeting USD 360,000 for the work in Phase II as outlined in the Phase II Mandate section above.

In Phase II, the ADPC will continue with producing the agreed outputs together with a continuation of management of all legacy programs including the management of the Subsidy Fund for Security Service Providers.

Management of the Subsidy Fund for Security Services [Work Package 2]

Regarding the Management of the Subsidy Fund for Security Services [Work Package 2], given the operational effort to set up and run such a fund, as described in Work Package 2 above, we would usually charge a management fee including Operational Expenses as a percentage fee of the value of the fund.

In this case, however, given that this is the pilot phase for the fund and that all the pre-work to set the fund up including the passing of the Tally vote and liaising with the Arbitrum Foundation has already been completed, we will waive all fees to run the fund in the pilot phase as a sign of our commitment and in order to make it as seamless as possible to prove the success of the fund in this first iteration.

This fee waiver only applies to the current proposal. If there is an extension to the Subsidy Fund in the future, management fees will be included in the respective proposal.

Operational Expenses Budget

Phase I highlighted the importance of including operational expenses in the budget: This is necessary to engage external subject matter experts - as we did with DeDaub in Phase I - and cover operational expenses such as third party communication tools and collaboration infrastructure.

To take this into account, we propose an additional budget of 15% Operational Expenses which will be allocated for the engagement of SMEs and for other operational expenses and running costs. The Operational Expenses budget includes (non-exhaustive):

- Infrastructure set-up for essential tools and infrastructure like centralized accounts for email, collaboration platforms, and document management systems;

- Implementing comprehensive document retention and IP management policies;

- Creating standardized templates and workflows for common processes;

- Allocation of budget for specialized external SMEs to address complex issues efficiently;

- Budget flexibility to accommodate unexpected challenges and community engagement needs.

The remaining unused funds of this sub-budget will be returned to Arbitrum’s treasury after Phase II has been concluded.

The Operational Expenses Budget for Phase II will total USD 54,000.

ARB Token Calculation

To determine the ARB token amount, we used the 14-day Time-Weighted Average Price (TWAP) of ARB/USD, each as listed EOD UTC, until EOD on Thu Sep 19 on CoinGecko (https://www.coingecko.com/en/coins/arbitrum/historical_data), prior to the proposal being posted on Tally. This method ensures a fair and current valuation while mitigating short-term price volatility. We'll add a 20% buffer to this amount to account for potential price fluctuations between proposal submission and execution. The remaining unused funds of this buffer will be returned to Arbitrum’s treasury after the conversion has been concluded.

Total Budget

The total budget requested is 954,608 ARB. Please find the Google sheet with the corresponding calculation of the TWAP ARB Amount here.

A detailed breakdown of the budget can be found in the Google sheet here.

VII. Methodology for Shortlisting Verticals for Phase II

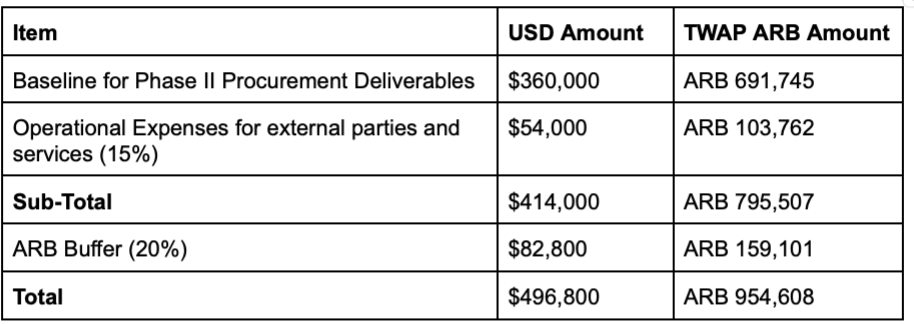

Methodology

In order to identify the verticals that will be most beneficial for the ADPC to tackle in Phase II, we created a non-weighted scoring system to rate all verticals against the following factors:

Importance to Projects on Arbitrum

This factor takes into account the importance of the vertical with respect to the following criteria:

- Frequency of use of the vertical by Projects;

- Estimated spend under the vertical;

- Feedback from Arbitrum stakeholders regarding importance of vertical to Arbitrum ecosystem growth; and

- The extent to which the Procurement Framework (PF) vertical helps make the process of building on Arbitrum, both for existing and new projects, more streamlined, cost-effective, and attractive, while simplifying and standardizing their engagement with service providers.

Higher ratings indicate higher levels of importance.

Importance to DAO Proposals & Initiatives

The extent to which the PF solves issues faced by existing DAO proposals and initiatives, helps operationalize them, and increases their chances of success. Higher ratings indicate higher levels of importance.

Solving Existing DAO Needs

The extent to which the PF solves issues faced by the DAO in general, and how significantly the PF will help professionalize and operationalize the DAO further. Higher ratings indicate higher levels of utility to the DAO.

Overlap with Existing DAO Initiatives / Structure

There are initiatives in the DAO or from the Foundation that are already tackling the problem solved by the PF. The ranking will take into account how well the PF vertical avoids overlap/duplication. Higher scores indicate PF is better at avoiding overlap/duplication.

Procurement Complexity / Cost

The complexity of constructing the procurement framework and the cost to do so. Higher ratings indicate lower complexity.

Monetary Savings for Projects on Arbitrum

This criterion evaluates cost savings for projects on Arbitrum resulting from an implementation of the respective PF. Higher ratings indicate greater cost savings.

Monetary Savings for DAO

This criterion evaluates cost savings for the DAO resulting from an implementation of the respective PF. Higher ratings indicate greater cost savings.

Increase in Deployment Efficiency

This criterion evaluates the extent to which an introduction of the PF makes deployment for new projects more efficient. The greater the efficiency improvements, the higher the rating.

Each of these factors are rated on a scale of 0 (Not Applicable at All), 1 (Low), 2 (Medium), 3 (High), and higher scores are better.

Note: Some of these factors are not applicable to some verticals. As such, the final score for each vertical is the percentage it has achieved, to enable comparability between verticals. For example, if the Events vertical has 6 factors that are applicable to it, the maximum score it can achieve is 18 and its final score is the percentage of the score it has achieved out of 18, so if it has achieved 17, its final score is 94%.

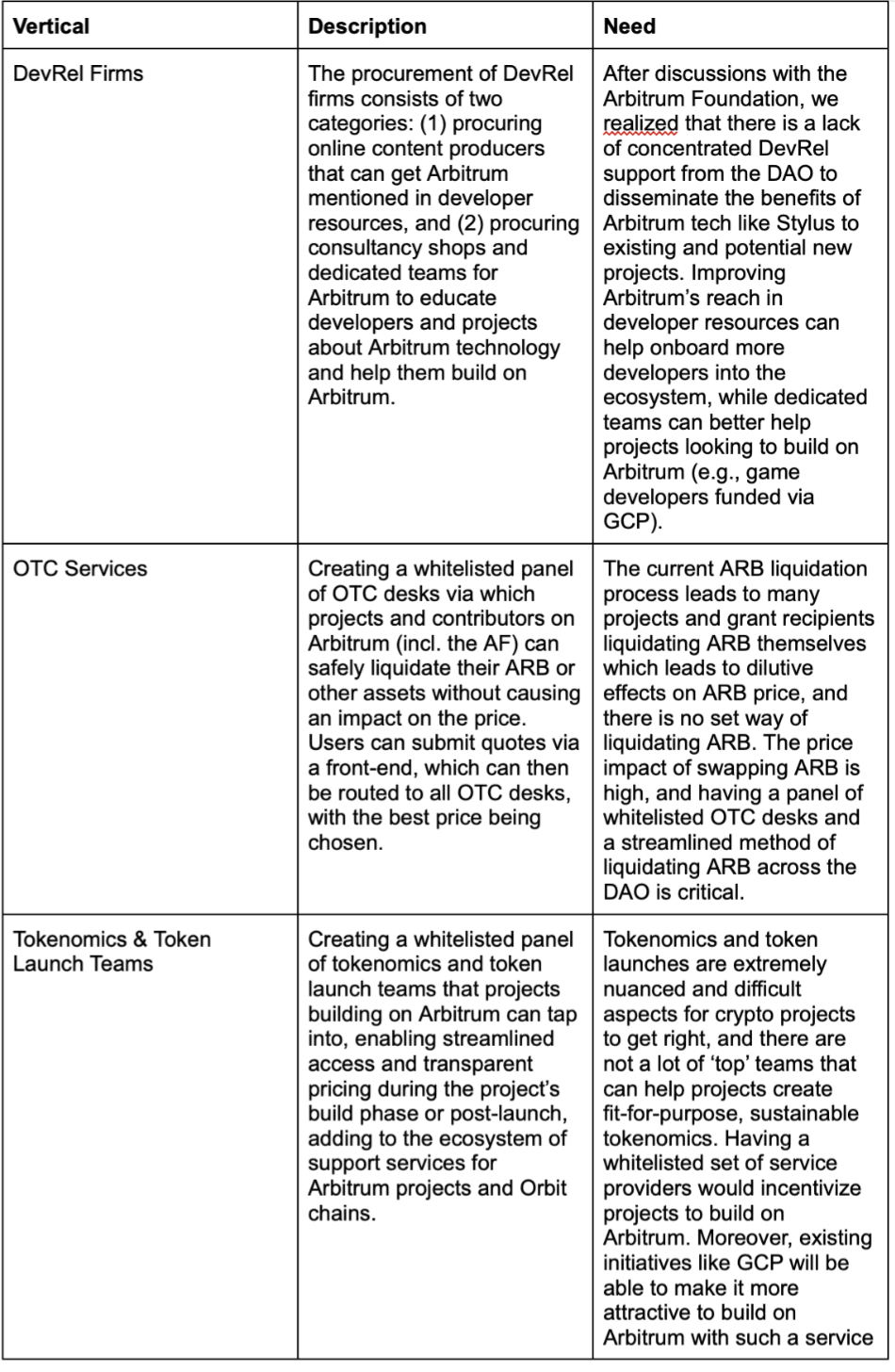

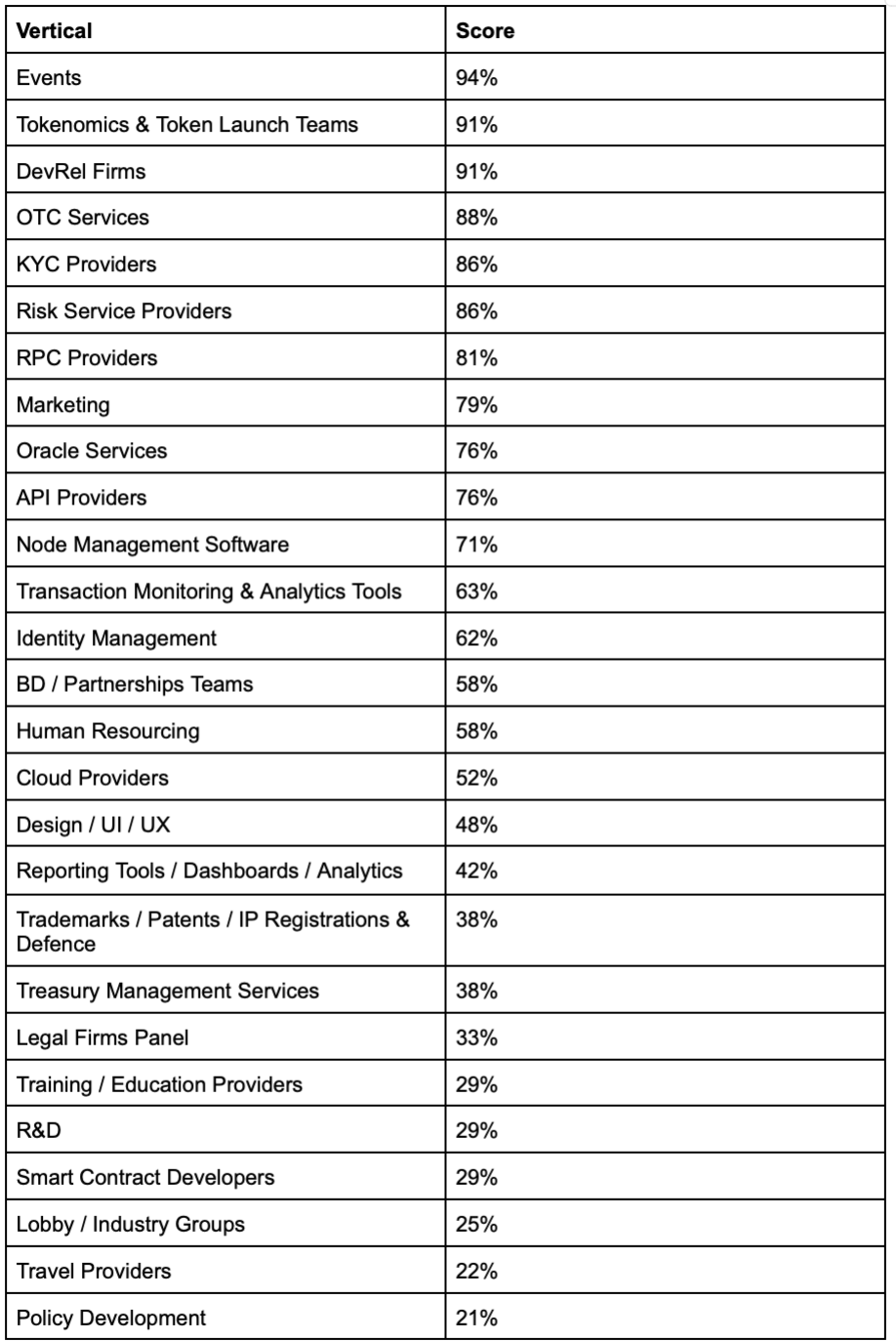

Application of Methodology to Frameworks

We identified 27 verticals that we could potentially tackle in Phase II. The below table represents the scores per vertical with the methodology applied, in order from highest to lowest. For a detailed breakdown of the application of the methodology with rationales for each individual score, please see the table here.

The verticals we selected to obtain further feedback on from high-context delegates, existing projects on Arbitrum, and new projects looking to build on Arbitrum, were those with scores >80% and constitute the below verticals:

The verticals we selected to obtain further feedback on from high-context delegates, existing projects on Arbitrum, and new projects looking to build on Arbitrum, were those with scores >80% and constitute the below verticals:

1. Events

2. Tokenomics & Token Launch Teams

3. DevRel Firms

4. OTC Services

5. KYC Providers

7. RPC Providers

Note:

We did not initially include Risk Service Providers in the list of verticals since these were already available to the DAO via the ARDC. As such, we did not ask for specific feedback from delegates and stakeholders for this vertical.

However, given that the ARDC may eliminate this function in its next iteration, we decided to include it in our list and, as it scored very highly, include it in the list of verticals to potentially tackle in Phase II.

Community Engagement & Feedback Collection

After shortlisting the top six verticals, we decided to validate the shortlisted verticals with high-context delegates, existing Arbitrum projects, and new projects aiming to build on Arbitrum. The intention was to further narrow down the verticals to the two we would tackle in Phase II.

We reached out to 25 stakeholders for feedback: L2Beat, Coinflip, GMX, DK, Gauntlet, Wintermute, Griff Green, Blockworks, Frisson, JoJo, Jones DAO, Pepperoni Jo3, Treasure, Camelot, Cattin, Premia, MUX Protocol, MaxLomu, Bob Rossi, Karpatkey, Princeton Blockchain Club, Bobbay, Angle Protocol, Merkl, and PaperImperium.

Based on our interactions with the community, we decided to move forward with the procurement of RPC providers as the first vertical. This is because RPC costs are high, RPCs are critical for projects to deploy, similar to security audits, and technical due diligence around infrastructure providers is a complex task that drains time and resources from projects. As such, creating a panel of whitelisted RPC providers streamlines the building process for projects.

In addition, we locked in 'Events' as a second vertical. The reason for this is that we spoke with Entropy Advisors about the need for a coherent events strategy for Arbitrum DAO, which is also apparent from the multiple concurrent events proposals being proposed in the DAO. As a result, we decided to create a proposal alongside Entropy Advisors and DisruptionJoe to establish a DAO Events Strategy for 2025, which will be published soon. While the proposal on the DAO Events Strategy for 2025 is focused on defining in particular the type and distribution of events as a first step, event services and event providers have to be procured in a second step to execute on the identified strategy. This second step, i.e., the provision of those procurement services for the identified events, is the subject of this proposal.

VIII. Transparency & Community Engagement

As in Phase I, the ADPC commits to maintaining its high standards of transparency and community engagement. We will:

- Continue to hold bi-weekly calls with the entire Arbitrum community, and when need be, make this more frequent;

- Continue to update the ADPC Update Thread on the forum;

- Post all meeting minutes and tasks on the ADPC’s public dashboard, with a view to further enhancing the dashboard to provide even more information to the community.

IX. Checks & Balances

Kindly note that Phase II of the ADPC’s term will be subject to the same checks and balances found within the Procurement Committee proposal, regulated by an agreement entered into by all elected ADPC Members, with the Arbitrum Foundation serving as a counterparty to the agreement. These checks and balances include:

- Conflict of Interest Provision: ADPC Members will be bound to act in absolute good faith, utmost honesty, refraining from deriving unauthorized profits from their position & disclose conflicts of interest. ADPC members should always disclose any potential or actual conflicts of interests to other ADPC members who will then proceed to mitigate the respective ADPC Members’ involvement in the task in relation to which such ADPC Member is conflicted.

To sum up, all ADPC Members must declare the nature and extent of any interest, direct or indirect, which the ADPC Member is aware that she, he or it has in a proposed task at hand.

- Record-keeping and Reporting: Comprehensive and precise record-keeping is imperative. ADPC Members will be required to maintain detailed accounts and documentation of the ADPC’s internal operational workflow together with meeting minutes. Furthermore, periodic reporting is essential so as to keep the ArbitrumDAO updated re. Task-specific progress & internal ADPC Administration.

- Duty of Impartiality: ADPC Members will have an obligation to act in an impartial manner in relation to their tasks & workflow, ensuring that the ADPC is not compromised by personal interests or external influences.

- Obligation of Recusal: ADPC Members with a conflict of interest involving a project and/or service provider being reviewed by the ADPC should recuse themselves from participating in the evaluation, facilitation & administration of the applicable procurement process.

- Prohibition of Self-Dealing: Participants should refrain from voting on sending funds to themselves or organizations where any portion of those funds is expected to flow to them, their other projects, or anyone they have a close personal or economic relationship with.

- Ethical Trading: Members are required to follow ethical trading standards concerning ARB and any other relevant digital assets.

X. Multi-Sig

We propose to use the Multi-Sig Support Service for Arbitrum DAO. Accordingly, we have taken advantage of the cost savings associated with that service and not included any costs for multi-sig management in this proposal.

XI. ARB Conversion Strategy

The ADPC will utilize a Protocol-Owned Execution strategy on Aera to convert the program’s ARB into USDC for operational purposes. The Protocol-Owned Execution strategy utilizes off-chain logic to monitor onchain liquidity and model the price impact of trading. The ADPC will use an Aera Vault, with Gauntlet as the guardian, to execute the conversion. Trade execution is scheduled and sized according to impact modeling and executed on Odos, or Bebop. Based on current market conditions, it would take approximately one week to trade out of 414K USD worth of ARB with minimal impact.

Protocol-Owned Execution

The Protocol-Owned Execution strategy uses off-chain logic to monitor onchain liquidity, model price impact, and plan the execution of active and passive trading. Based on current market conditions, it will take < 1 week to swap out of 414k USD worth of ARB with minimal impact.

For ARB on the Arbitrum Chain, Gauntlet will swap out tokens using either Odos (DEX aggregator) or BeBop (self-execution solver).

Passive execution uses concentrated ARB positions in an ARB/USDC pool (Odos supports projects such as Camelot, Uniswap V3, and more). The amount converted through this position is periodically claimed, and a new ARB position is set in the pool. These can be thought of as limit orders.

Active and passive execution are used in tandem to maximize liquidity sourcing. Price impact modeling and gas cost determine the intraday trading schedule and size. Historical data is used to determine initial parameters. We continuously monitor slippage, intraday price impact, and medium-term price impact and adjust execution parameters if necessary.

Intraday price impact is measured as the likelihood of observable price divergence in the hour after trading. The medium-term impact is measured as the effect of trade size on the divergence relative to a peer benchmark.

The example chart shows rolling slippage for one of Aera’s Trade Execution Customers.

The example chart shows the likelihood of intraday impact for one of Aera’s Trade Execution Customers.

ADPC Vault Parameters

ADPC Vault Parameters

- Chain: Arbitrum

- Vault Owner: MSS (arb1:0x13d4Ff2A83fBCB8F5fc73cE66CF5928eD0943cB0)

- Guardian: Gauntlet

- Tokens: ARB, USDC

- Protocols: Odos, Bebop, Llamapay

- Strategy: Swap ARB for USDC; minimizing market impact

- Payment Stream: streamed continuously over 6 months once the swap from ARB to USDC is complete

- Fee: 0%

ADPC Members Payment Process

Once the ARB is converted into USDC, the Aera vault will utilize LlamaPay to stream the total payment due to the ADPC member wallet addresses over the course of the 6-month period (120k USDC per member, 360k USDC in total). The remainder of the converted funds (54k USDC) will remain in the MSS as the OpEx budget. This process will be coordinated with the MSS chairs and members.

About Aera

Aera is an on-chain solution to optimize DAO funds autonomously. It addresses the common pain point of inactive treasury management, which often hinders a DAO’s ability to maintain its runway, cover liabilities, and benefit from market growth. Unlike traditional institutions that rely on agile managers for fund allocation, DAOs face unique challenges, including governance and incentive alignment with external managers.

To address these, Aera offers a unified solution for efficiently and transparently managing on-chain treasuries, grants, and incentive funds through customizable vaults. Aera vaults can hold stablecoins, native tokens, and other cryptocurrencies, with their objective functions tailored to each DAO’s needs. Guardians leverage off-chain logic to automate rebalancing decisions, ensuring the vaults meet their objectives across various market scenarios and time horizons.

You can read more about Aera here.